What if your money could work for you—even while you sleep?

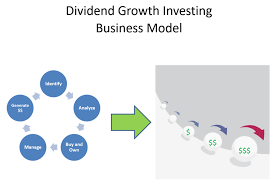

That’s the idea behind Dividend Growth Investing (DGI): a strategy where you earn consistent, growing income just by owning shares of high-quality companies.

It’s not flashy. It’s not trendy. But it works—and it’s helped millions of investors grow long-term wealth.

Let’s break down how it works and why it might be the smartest move you’ve never made.

✅ What Is Dividend Growth Investing?

Dividend Growth Investing is all about putting your money into companies that not only pay dividends—but increase them consistently over time.

Instead of hoping for quick gains, you’re building a rising stream of passive income and allowing compound growth to do the heavy lifting.

💵 First, What’s a Dividend?

A dividend is a portion of a company’s profits paid to shareholders. If you own stock in a company that pays a dividend, you’ll get regular payments—usually every quarter.

For example:

- Own 100 shares of a company paying a $1.50 annual dividend?

- You get $150 per year—just for holding the stock.

And when those dividends grow every year? Your income grows too—without you buying more shares.

📈 The “Growth” Is What Builds Wealth

Here’s why dividend growth matters:

| Year | Dividend Per Share | Your Income (100 Shares) |

|---|---|---|

| 2022 | $2.00 | $200 |

| 2023 | $2.10 | $210 |

| 2024 | $2.21 | $221 |

| 2025 | $2.33 | $233 |

With nothing but time and reinvested dividends, your income—and net worth—starts to grow exponentially.

💡 Why Choose Dividend Growth Investing?

Here’s what makes DGI a favorite for long-term investors:

- Steady, Predictable Income

Even if the market dips, dividends often keep rolling in. - Compounding Power

Reinvest dividends to buy more shares—earning you even more dividends. - Inflation Protection

Rising dividends help maintain your purchasing power over time. - Financial Freedom

Enough growing dividend income can eventually cover your living expenses. - Low Stress, High Conviction

DGI investors often hold shares for decades, skipping the stress of constant trading.

🔍 What to Look For in Dividend Growth Stocks

Not all dividend stocks are created equal. Here’s what separates the best:

- Consistent Dividend Increases (10–25+ years is ideal)

- Reasonable Payout Ratio (typically under 60%)

- Strong Cash Flow to support ongoing growth

- Resilient Business Models in stable industries

Examples of dividend growth favorites:

- 🧼 Procter & Gamble (PG)

- 🥤 Coca-Cola (KO)

- 🏥 Johnson & Johnson (JNJ)

- 🛒 Walmart (WMT)

- 🌐 Microsoft (MSFT)

🚀 How to Get Started with DGI

- Open a brokerage account (look for one with no trading fees and dividend reinvestment options).

- Research reliable dividend growth stocks—start with the Dividend Aristocrats (25+ years of increases).

- Start small, and invest regularly.

- Reinvest your dividends to boost compounding.

- Think long-term—decades, not days.

🎯 Final Thoughts

Dividend Growth Investing is a slow and steady path—but it’s one of the most reliable ways to grow rich over time.

It rewards patience. It compounds quietly.

And best of all? It pays you to stick with it.

Get paid. Grow rich. And enjoy the journey.