1. AST SpaceMobile (Ticker: ASTS)

6

Why it stands out: AST is building a satellite constellation enabling standard smartphones to connect directly to space (no ground towers). One of the cited investment theses is that the company could address billions of unconnected users. FXCM Markets+1

Key risks: High execution risk, capital‑intensive business, depends on regulatory/partnership success.

2. Rocket Lab USA (Ticker: RKLB)

6

Why it stands out: Focuses on satellite launches (small/medium payloads) and is developing a larger rocket (Neutron) for bigger missions. The launch business is a foundational part of the space economy. The Motley Fool+1

Key risks: Highly competitive market (e.g., with SpaceX), margins under pressure, launch failures are costly.

3. Intuitive Machines (Ticker: LUNR)

6

Why it stands out: A company building lunar surface access and payload‑delivery services. Has contracts via NASA’s Commercial Lunar Payload Services (CLPS) programme. Wikipedia+1

Key risks: Revenue can be lumpy, dependent on mission success, longer time‑horizon for returns.

4. BlackSky Technology (Ticker: BKSY)

6

Why it stands out: Operates Earth‑observation satellites delivering high resolution imagery and analytics, a growing segment for government and commercial users. Mitrade+1

Key risks: Imagery/data business can face margin pressure, competition from low‑cost satellite players.

5. Redwire Corporation (Ticker: RDW)

6

Why it stands out: Focused on space infrastructure (manufacturing, assembly, habitats) – a less glamorous but highly strategic piece of the space value chain. FXCM Markets+1

Key risks: Longer lead times, many enabling technologies still maturing, high capital spend.

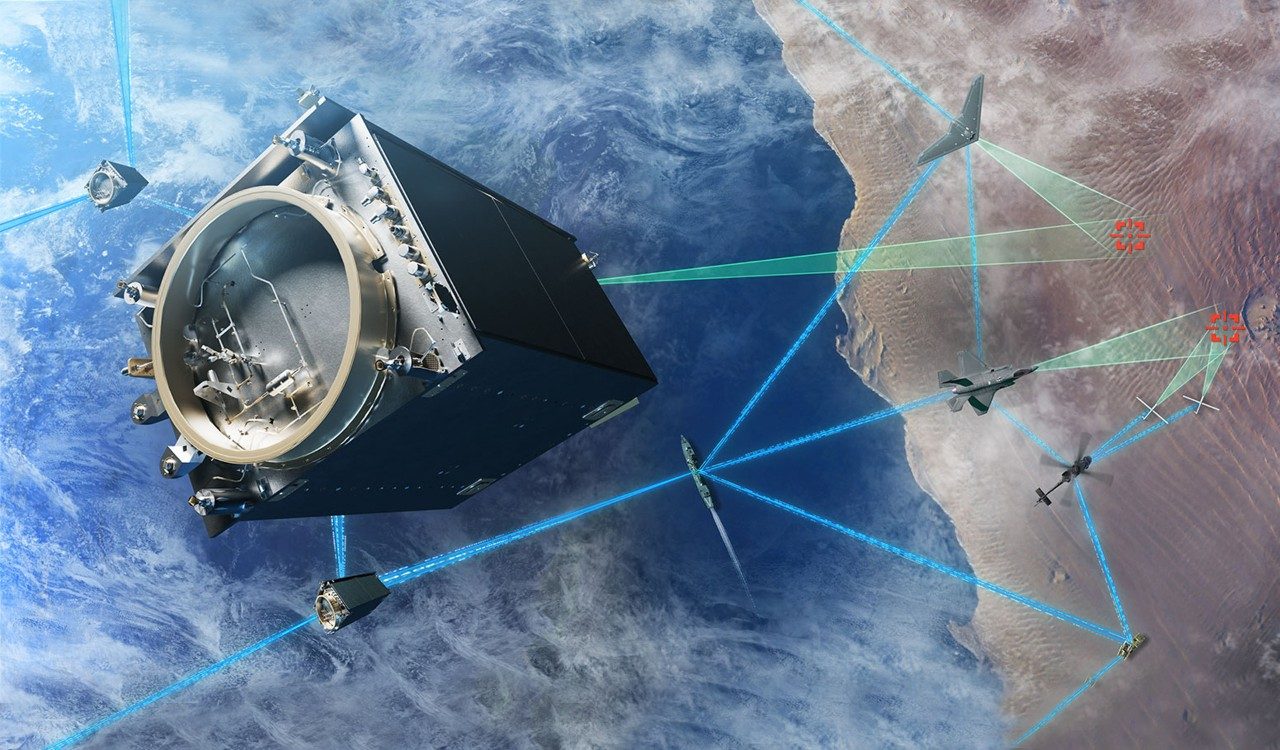

6. Lockheed Martin Corporation (Ticker: LMT)

6

Why it stands out: A large‑cap defence/space company giving indirect exposure to the space boom but with more stability (government contracts, diversified business). FXCM Markets

Key risks: Slower growth, less speculative upside, more tied to defence/government budgets.

7. Firefly Aerospace

6

Why it stands out: A launch/lander business with recent attention for lunar payload delivery vehicles and growing backlog. Analyze Stocks

Key risks: Execution risk high, early stage, still proving business model.

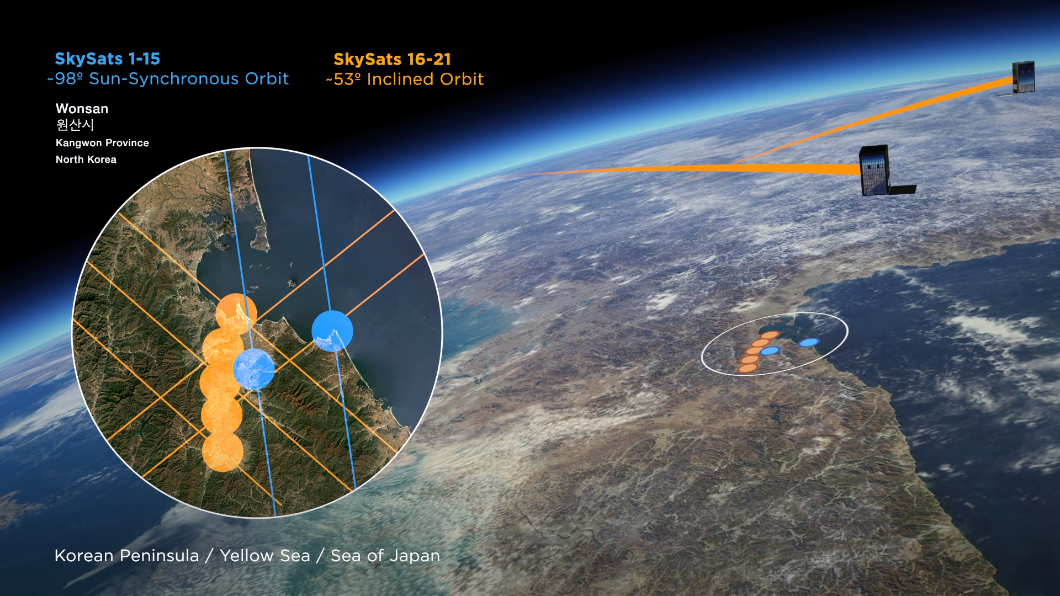

8. Planet Labs PBC (Ticker: PL)

6

Why it stands out: Operates a large fleet of small satellites providing frequent Earth imaging – valuable for agriculture, environment, mapping, intelligence. MarketWatch

Key risks: Many satellites = high operating cost, competition from others offering similar data.

9. Spire Global Inc. (Ticker: SPIR)

6

Why it stands out: Offers satellite‑based data/analytics for weather, maritime, aviation – a niche but growing part of the space economy. MarketWatch

Key risks: Niche market, reliant on subscription/data revenues, may face pricing pressure.

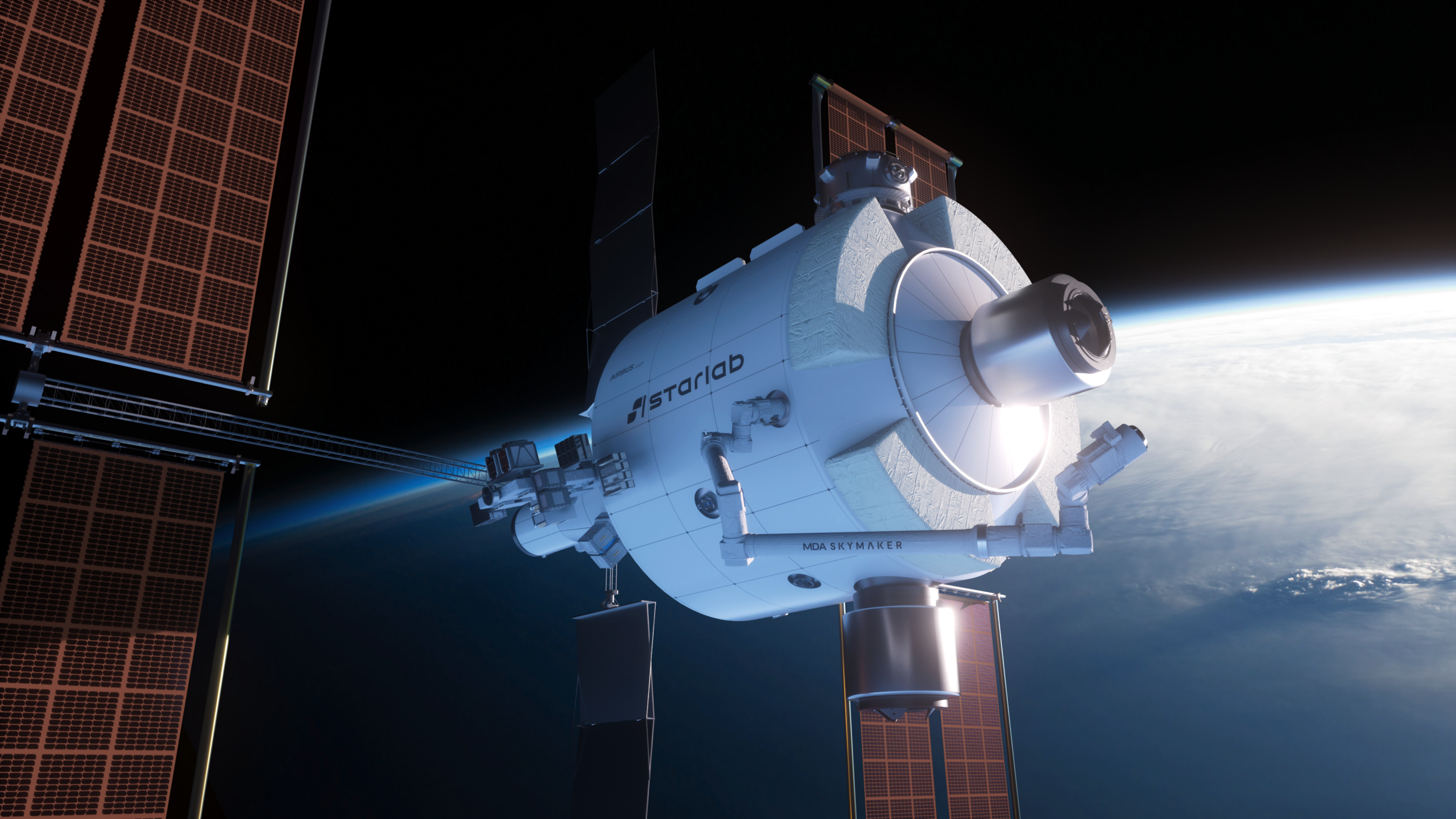

10. Voyager Technologies (Ticker: VOYG)

6

Why it stands out: Developing commercial space station / habitats (post‑ISS era) and related infrastructure – positioned for the “next frontier” of space economy. FXCM Markets+1

Key risks: Very long horizon, still speculative, heavy capital required.

✅ Investment Themes & What to Look For

- Launch & transport: Getting payloads to orbit reliably and cheaply (Rocket Lab, Firefly)

- Satellite infrastructure & services: Data, connectivity, imagery (Planet Labs, Spire, AST)

- In‑orbit services & habitats: Manufacturing, servicing, commercial stations (Redwire, Voyager)

- Defense/space mega players: More stable but less explosive (Lockheed Martin)

- Mission & lunar economy: New markets in cislunar & lunar surface (Intuitive Machines)

⚠️ Key Risks to Keep in Mind

- Long time horizons: Many of these companies are still building; profits may come years out.

- Capital intensity: Space is expensive – rockets, satellites, ground stations all cost lots.

- Technical & mission risk: Launch failures, regulatory issues, technology setbacks matter.

- Valuation & speculation: Some stocks may already reflect high expectations; downside is real.

- Macro & geopolitical factors: Government budgets, export controls, space treaties can affect outcomes.