As the world pushes toward net-zero emissions, carbon credit trading is emerging as a powerful tool in the global effort to fight climate change. But what exactly are carbon credits, and how does trading them work?

Let’s break it down — and explore how businesses, investors, and governments are using this growing market to both reduce emissions and create economic value.

What Are Carbon Credits?

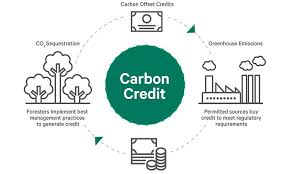

A carbon credit represents one metric ton of carbon dioxide (CO₂) or its equivalent in other greenhouse gases that has been either:

- Removed from the atmosphere, or

- Prevented from being emitted

These credits are created through certified carbon offset projects, such as:

- Reforestation or afforestation

- Renewable energy generation

- Methane capture from landfills

- Soil carbon sequestration

- Direct air carbon capture (DAC)

Companies and governments use these credits to offset their own emissions, helping them meet sustainability goals or regulatory requirements.

How Carbon Credit Trading Works

Carbon credit trading allows entities that reduce more emissions than required to sell their extra credits to others who are unable to meet their limits.

There are two main markets:

1. Compliance Markets

- Created by government regulations (e.g., EU ETS, California Cap-and-Trade)

- Emission limits (caps) are set; companies must buy credits if they exceed them

- Heavily regulated and often mandatory for large polluters

2. Voluntary Carbon Markets (VCM)

- Open to any company or individual seeking to offset emissions

- Companies buy credits to meet self-imposed sustainability targets

- Supports carbon reduction projects globally

Why Carbon Credit Markets Are Growing

Several trends are fueling the growth of carbon credit trading:

- Net-Zero Commitments: Over 140 countries and 5,000+ companies have pledged carbon neutrality.

- Corporate ESG Pressure: Investors and consumers are demanding transparent climate action.

- Innovation in Offsets: New technologies (like direct air capture) are improving verification and scalability.

- Market Value: The voluntary carbon market could reach $50 billion by 2030, according to McKinsey.

💼 Who’s Participating in Carbon Credit Trading?

- Corporations: To meet ESG targets and offset Scope 1, 2, or 3 emissions

- Governments: Regulate and operate compliance markets

- Investors & Traders: Speculate or invest in carbon ETFs and futures

- Developers: Create and verify offset projects that generate credits

- Exchanges & Platforms: Facilitate the buying and selling of credits (e.g., Verra, Gold Standard, Xpansiv)

💰 How to Invest or Trade in Carbon Credits

You don’t need to be a multinational polluter to get involved. Here’s how:

1. Carbon Credit ETFs

- KRBN (KraneShares Global Carbon ETF)

- GRN (iPath Series B Carbon ETN)

These track global carbon prices and offer diversified exposure to regulated markets.

2. Buy Verified Credits

Platforms like Gold Standard, Verra, and Carbon Trade Exchange allow individuals and companies to buy credits to offset emissions or support specific projects.

3. Carbon Credit Futures

Traded on platforms like ICE and CME, carbon futures allow traders to bet on the future price of credits — a more complex but potentially profitable option.

4. Invest in Carbon Offset Projects

Put your money directly into afforestation, soil carbon, or renewable energy initiatives and receive returns from the sale of generated credits.

⚠️ Challenges to Watch

While promising, the carbon market is still developing and has some notable risks:

- Greenwashing: Some companies may misuse offsets to avoid real reductions.

- Verification Issues: Not all carbon credits are created equal — some projects may not deliver promised reductions.

- Regulatory Uncertainty: Global frameworks are still evolving, and voluntary markets lack uniform standards.

- Price Volatility: Credit prices can fluctuate with policy changes, demand shifts, or scandals.

🌍 Final Thoughts: Why Carbon Credit Trading Matters

Carbon credit trading isn’t a silver bullet — but it’s a valuable transition tool.

It helps:

- Fund carbon-saving projects

- Incentivize emissions reductions

- Provide flexibility to businesses

- Unlock economic opportunities in sustainability

As carbon markets mature and standards improve, carbon credit trading could play a critical role in the race to net zero — and offer compelling opportunities for impact-driven businesses and investors alike.

💬 Want to Learn More?

In a future post, we’ll dive deeper into how to evaluate the quality of a carbon credit and top platforms for carbon trading in 2025. Subscribe or follow for updates!