Greater Awareness

-

Since GE HealthCare Technologies stock is subject to high risk, GE HealthCare Technologies stock prices may be subject to the risk of their trading decisions.

-

The top 11 shareholders own 51% of the company

-

The latest products are insiders

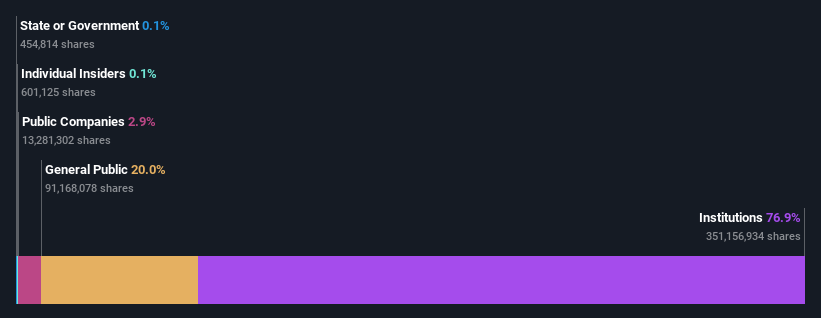

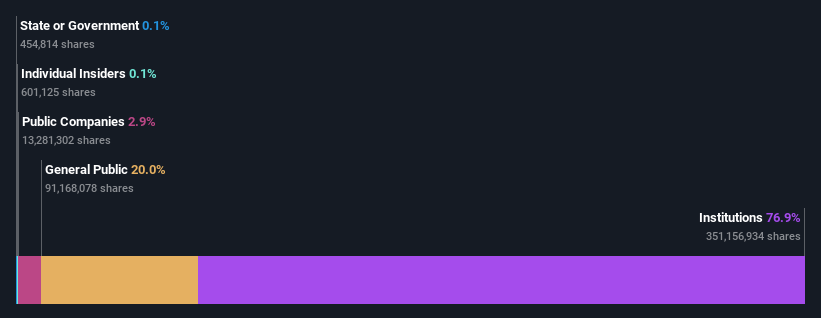

A look at the shareholders of GE HealthCare Technologies Inc. (NASDAQ:GEHC) can tell us which group is the strongest. The group that has the most shares in the company, about 77% to be exact, are corporations. In other words, the team faces high potential (or low risk).

Since organizations can earn more money, their market behavior is more closely monitored by retailers or private sellers. Therefore, having a large amount of venture capital for companies is often considered a valuable asset.

Let’s take a closer look to see what different types of shareholders have to say about GE HealthCare Technologies.

You can view historical listings for GE HealthCare Technologies Ltd

What Does Institutional Ownership Tell Us About GE HealthCare Technologies?

Corporations often measure themselves against a standard when they report to their investors, so they are often more bullish on stocks once they are included in the main list. We expect that many companies will have other organizations on the register, especially if they are growing.

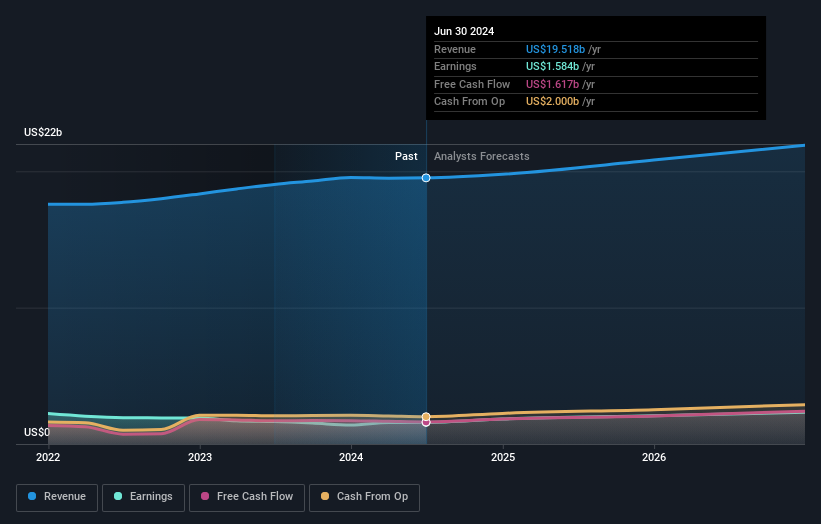

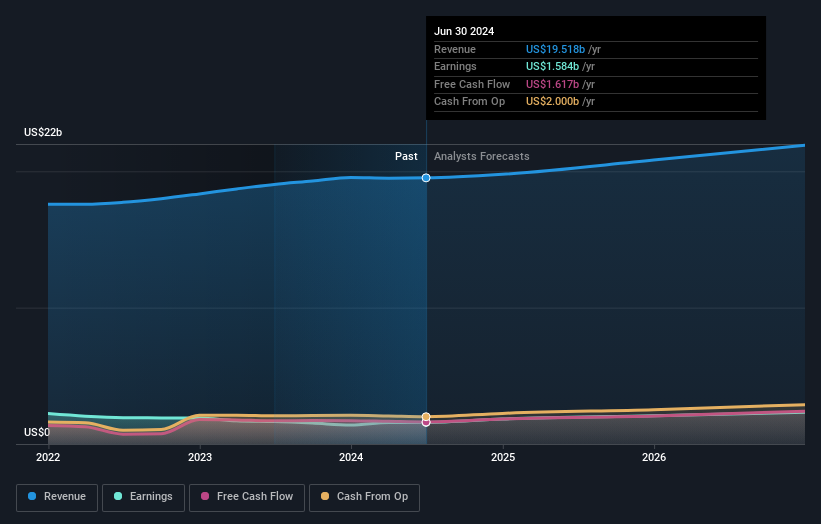

We can see that GE HealthCare Technologies has corporate income; and owns a good share of the company’s stock. This may indicate that the company has some credibility in the financial sector. However, it is best to be cautious in relying on the assurances that come with institutional investors. They, too, make mistakes sometimes. If several organizations change their views on a stock at the same time, you can see the stock price drop quickly. So it is important to look at the GE HealthCare Technologies images below. It is true that the future is very important.

Since institutional investors account for more than half of the funds allocated, the institution must be responsive to their preferences. GE HealthCare Technologies is not owned by hedge funds. Our data shows that Capital Research and Management Company is the majority shareholder with 12% of the shares in the majority. With 11% and 7.9% of the shares outstanding respectively, The Vanguard Group, Inc. and BlackRock, Inc. and second and third party owners.

After further research, we found that the top 11 own 51% of the company, which means that no single shareholder has any control over the company.

While studying company ownership can add value to your research, it’s also a good way to research expert opinions to gain a deeper understanding of the stock’s prospects. There are quite a few analysts who report on the stock, so it would be useful to know all their future opinions.

Insider Owner of GE HealthCare Technologies

The definition of corporate entrants can be subjective and varies between jurisdictions. Our findings reveal who is inside, based on board members at least. The company’s directors are accountable to the board and the latter must represent the interests of the shareholders. In particular, sometimes top management sits on the board alone.

Many consider insider ownership to be good because it can show the company is in better touch with its shareholders. However, sometimes more energy is placed within this group.

Our latest data shows that insiders own less than 1% of GE HealthCare Technologies Inc. Since it’s a large company, we can only expect insiders to own a small amount of it. But it is worth noting that they have shares worth US$ 53m. In this type of situation, it can be very interesting to see if the insiders have been buying or selling.

General Public ownership

With a 20% ownership stake, the general public, especially individual investors, has a vested interest in GE HealthCare Technologies. Although this group may not call the shots, they can have a real influence on how the company is run.

Alternatives:

It is always a good idea to consider the different groups that have shares in the company. But to fully understand GE HealthCare Technologies, we need to consider many other things. For example, we have found Two warning signs for GE HealthCare Technologies what you need to know before using it here.

If you’re interested in finding out what experts are predicting about future growth, don’t miss this free report on analyst forecasts.

NB: The figures in this article are calculated using data for the last twelve months, which refers to the 12-month period that ends on the last day of the month in which the financial statement is written. This cannot be compared to the figures for the whole year.

Have a comment on this story? Worried about content? Contact each other and us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is more general in nature. We provide reviews based on historical data and expert forecasts using unbiased methods and our articles are not intended to be financial advice. It does not make recommendations to buy or sell any stock, and does not take into account your goals, or financial situation. We want to bring you long-term analytics driven by meaningful data. Note that our analysis may not be influenced by recent company announcements or stock prices. Simply Wall St has no position in any of the listed stocks.

#Healthcare #Technologies #NASDAQGEHC #favored #institutional #shareholders #company